Essential Steps to Buying a Property in Italy

Essential Steps to Buying a Property in Italy – Overview

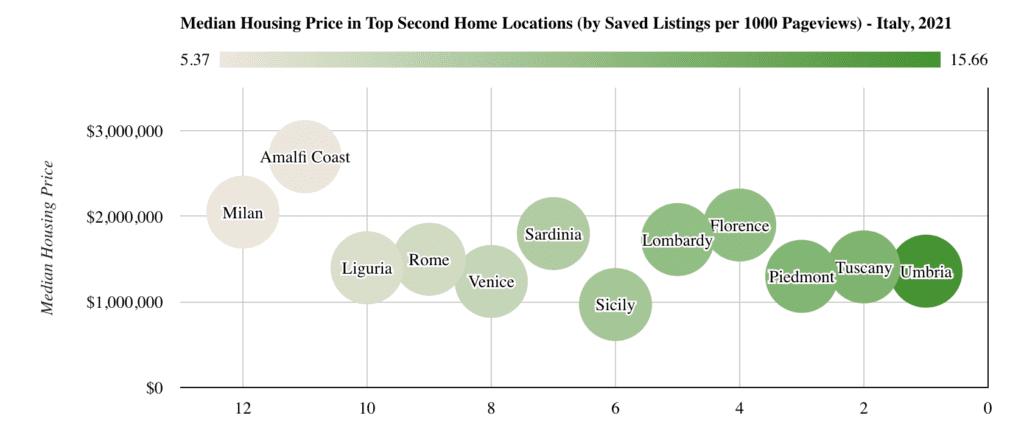

Essential Steps to Buying a Property in Italy – One of the world’s top five second-home destinations, Italy draws international interest with its gorgeous beaches, lakes, vineyards, and flat tax policy.

Italy is becoming a hotspot for high-net value individuals looking for a second home they can enjoy and also earn an income from.

Essential Steps to Buying a Property in Italy – Research from Knight Frank’s Global Buyer Survey recently ranked Italy as one of the world’s top five second-home destinations, with European and North American buyers particularly enjoying the beautiful lakeside lodges, snow-decked cottages for skiing and untouched beaches of the region.

Italy’s flat tax policy has drawn interest from non-nationals, as it allows overseas residents (irrespective of their citizenship), who move to Italy and become Italian tax residents, to pay a lump sum form of taxation on all non-Italian sourced income for up to 15 years.

New residents opting for this flat-tax regime will pay, instead of ordinary tax rates, a flat-rate tax of € 100,000 per year on all their non-Italian sourced income; this option lasts up to 15 years.

The regime can also be extended to any family member, who will be subject to € 25,000 annual tax instead of € 100,000.

Essential Steps to Buying a Property in Italy – Recognized as a largely “no restrictions” country, property purchases in Italy are quite straightforward for non-nationals but can take up to 6 months to process.

It is essential you acquire the right professional help, in the form of specialized solicitors and wealth management advisors, to streamline the process and ensure it takes place legally.

Transaction costs in Italy differ from property to property but can be up to 20% of the property value including foreign exchange fees, notary, and legal fees.

Essential Steps to Buying a Property in Italy – Finding the perfect second home in Italy is worth the effort and the steps below will help you along your journey:

Essential Steps to Buying a Property in Italy – What Affects Location

Distance from the sea, lakes, parks etc.

Beautiful views

Walking distance of shops, bars, restaurants, etc.

Distance from an International airport

Public transportation

Low crime

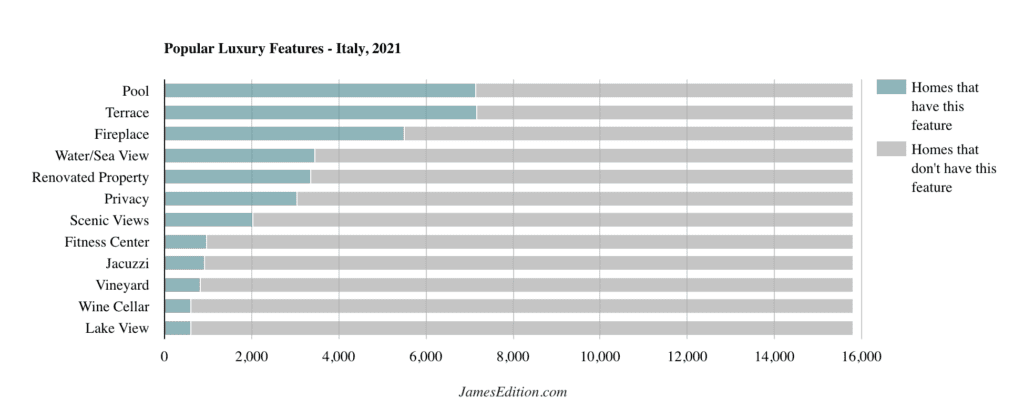

Essential Steps to Buying a Property in Italy – What Else Can Impact the Price of a Property?

Surface

Functional design

Interior and exterior finishes

Number of bedrooms and bathrooms

Terrace/garden

Garage/private parking

Swimming pool

State of maintenance/renovation work

Taxes

Essential Steps to Buying a Property in Italy

Essential Steps to Buying a Property in Italy – The Online Search

Essential Steps to Buying a Property in Italy – Exploring online, you can easily browse different destinations, get a feel for a range of locations, and narrow your shortlist down to the perfect properties for your needs.

Tips for Success: You may find your dream Italian property is represented by a number of different agencies.

Don’t be alarmed, this is quite normal and shouldn’t impact your chance to view and purchase.

Professional Help: Online marketplaces and forums and real estate agents.

Essential Steps to Buying a Property in Italy – The Online Search

In the internet age it seems intuitive that the first place to look for a home is online.

Yet soon an Italian reality sets in.

The Italian property market is frustratingly fragmented.

There isn’t one “go to” website such as Rightmove in the UK, Realtor.com or Zillow in the USA or Immobilienscout24 in Germany, there are many.

Soon you find yourself performing the same search 5 different ways on 5 different sites.

The search results on any particular site may include the same property listed 4 times – with 2 or more prices.

Other homes might not be listed on any of the sites except one, not so good if you don’t check the “right” place.

Some upscale properties are not publicly listed anywhere due to an owner’s desire for complete discretion.

There is no comprehensive Italian “MLS“ despite claims to the contrary.

It’s hard to believe but classified ads contain some real estate listings, depending upon the sellers expertise.

Strolling around a neighborhood is another approach looking high and low to sight vendesi signs.

Yet not all properties are visible from the street.

Nor do all available properties have signs posted as the owner may want a modicum of discretion.

The tools available today, besides ads in the papers, real estate publications and word of mouth, consist of the Internet, where both free and pay sites can be found, judiciary auctions and announcements via mobile phone text messages.

In Italy, it’s probably best to put a reputable real estate broker to work for you.

Essential Steps to Buying a Property in Italy – Choose Your Location

Essential Steps to Buying a Property in Italy – Italy’s rich culture, vibrant art scene, renowned culinary heritage, and jaw-dropping landscapes make it the ultimate vacation destination.

Italy’s varied regions — from the rolling hills of Tuscany to the dramatic seascapes of the Amalfi Coast — are a feast for the senses, each offering a distinct and memorable experience.

Stroll along the ancient cobblestone streets of Rome or Florence, and you’ll be immediately transported to a different era.

Or, explore Milan’s world-famous dining and shopping scene.

Whether you’re a foodie, history buff, or design aficionado, Italy has plenty to offer, so it’s not surprising that many people opt to invest in a second home here.

In fact, the nation is now the top second home market for North Americans, according to Bloomberg.

Not only is real estate in Italy more affordable than other popular European vacation destinations like Spain and France, but lower transaction costs, tax incentives, and government assistance also lure foreigners to invest in vacation homes in the country.

Essential Steps to Buying a Property in Italy – Choose Your Location

Take time to explore the pros and cons of each area and consider your needs.

Do you want to live in an expat area or prefer something less popular with tourists?

What amenities and attractions do you need nearby?

Pro Tip: Explore online and you’ll find a range of local guides and information from experienced real estate agencies as well as residents in your chosen areas.

Professional Help: Online marketplaces and guides and real estate agents.

Essential Steps to Buying a Property in Italy – Finding The Right Property

Essential Steps to Buying a Property in Italy – Finding The Right Property

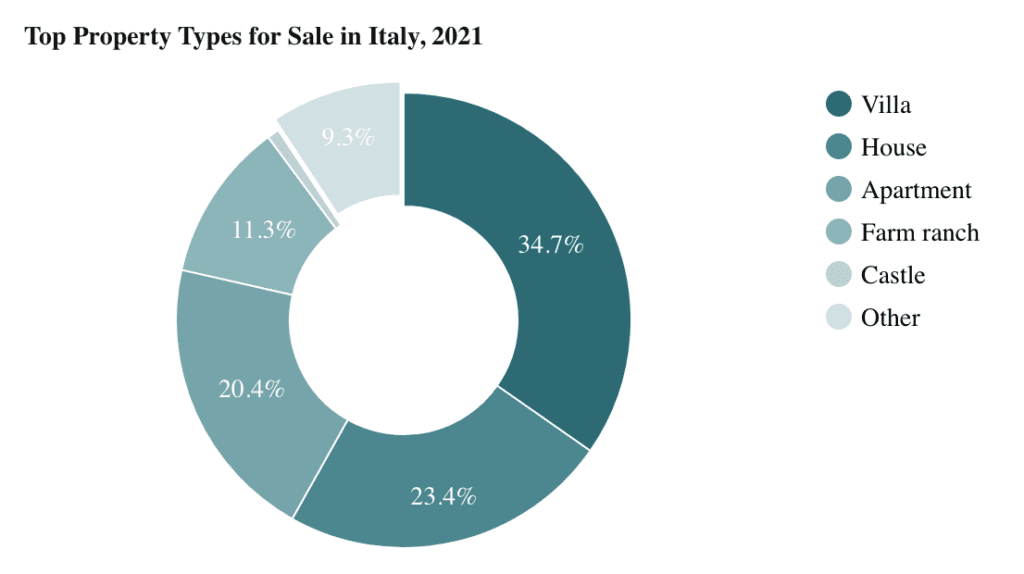

Pro Tip: If you’re looking for a rare historic property (either a Tuscan farm ranch, a castle or a palazzo), Italy is one of the top destinations in the world, with only France offering more castle-style properties for sale.

On the opposite end of the upscale market, newly-built apartments are available but represent a smaller percentage of the real estate stock.

But if you’re looking for a villa, there is definitely something elegant and unique for every buyer.

Professional Help: Real estate professionals

Essential Steps to Buying a Property in Italy – Freehold VS Leasehold Properties

The legalities around freehold and leasehold properties in Italy can be complex, so ensure you get appropriate professional advice.

Most new-build Italian property is sold freehold, but this isn’t always the case with older and renovated properties.

Keep in mind you do not need building permission to restore an Italian property, but you will need a SCIA (Certified Start of Activity Report) from your local municipal office.

There are also historical, artistic, landscape, environmental or hydro-geological protections for some properties so it is vital you get the right guidance from your advisors.

Pro Tip: Always take time to check before investing in a property which needs significant work.

Ensure all legal checks are conducted and the renovations you want to make can be legally carried out before you sign any contracts.

Professional Help: Wealth management advisor with real estate experience and architects or similar to assess historic properties.

Essential Steps to Buying a Property in Italy – Open Your Italian Bank Account

You require an Italian bank account to purchase your chosen property. It needs to be done in person. Prior to opening the account, you will need to obtain your codice fiscale or tax code.

You can apply for your codice fiscale either at the Italian Embassy in your home country or at any Revenue Office in Italy.

This code is essential for almost all day-to-day activities in Italy, including opening your bank account.

You can open an account at any branch of your chosen Italian bank, and you will need your passport, proof of address (even if abroad) and your codice fiscale.

Pro Tip: While it is not essential to open an Italian bank account and you can rely on your Notary, it is much more convenient and cost effective to have a bank account in Italy to run and manage your new second home.

Professional Help: solicitor or wealth management advisor with expertise in expat and international clients.

Essential Steps to Buying a Property in Italy – Finding The Right Real Estate Agent

There are 500+ Italy-based agencies registered on JamesEdition.com.

Almost 80% of them are local brokerage companies with no ties to global real estate brands.

The remaining 20% are represented by Coldwell Banker, Engel & Völkers, Sotheby’s International Realty, and Christie’s International Real Estate.

Make sure they are registered with one the following National Associations of Realtors: FIMAA, FIAIP, ANAMA or AICI.

Essential Steps to Buying a Property in Italy – Property Visits

You can view your shortlisted properties online and via virtual tours, but an in-person visit is always the best way to get a feel for the place.

Pro Tip: Take the time to visit different properties so you can truly get an understanding of your preferred neighborhoods.

Visiting properties advertised by different agents will also give you a more objective understanding of the areas.

Professional Help: Real estate agent / A wealth management advisor offering real estate services.

Essential Steps to Buying a Property in Italy – Property Due Diligence

Essential Steps to Buying a Property in Italy – Property Due Diligence

Due diligence should ensure everything is correct with the property, including any building permissions for renovation are in place and it is a legally built and legally on sale property.

Pro Tip: Most Italian properties can be renovated but make sure your advisors double-check if you plan to extend or redevelop the home.

Keep in mind many historic properties, such as castles and palazzi, may have protected status.

A specialist architect or property surveyor should be able to advise if there are going to be concerns with your building plans.

Professional Help: A wealth management advisor / Specialist property survey and valuation company

Essential Steps to Buying a Property in Italy – Italian Building Surveys to Consider

It is not mandatory in Italian law to have any building surveys conducted, but you will find mortgage lenders may insist. Some lenders require a perizia (survey) before they will approve finance.

This survey is usually a basic stima (valuation) to ensure the property is worth the purchase price.

Pro Tip: You should always request a building survey for historic properties.

While your mortgage lender may only need to double check the value of the property, you need to know you are investing in something structurally stable and suitable for your plans.

Builders and engineers routinely carry out checks and surveys on older properties while architects are more commonly employed to assess modern properties.

Professional valuers or geometra can also be used. Building surveys or perizia strutturale usually costs around €1,000.

Professional Help: A property survey and valuation company as well as relevant experts such as valuers, builders, or architects if necessary.

Essential Steps to Buying a Property in Italy – Finance Options Available

Pro Tip: UK expats in Italy must remember they cannot rely upon UK or US based financial advisors due to insufficient professional indemnity insurance.

Professional Help: A financial advisor from an EU or US based wealth management firm or local real estate company

Essential Steps to Buying a Property in Italy – Choosing a Mortgage Lender

Mortgage lenders will look at the affordability of the loan based on your application.

Pro Tip: Some Italian mortgage lenders ask for a survey to value the property and ensure it is worth the purchase price.

They will organize this independently.

Professional Help: A financial advisor from an EU or US based wealth management firm or local real estate company.

Essential Steps to Buying a Property in Italy – Money Transfer

High value money transfers come with fees attached, as you move your funds from your regular bank account to your Italian one.

Opt between transferring your funds via the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network or use a foreign exchange broker.

Pro Tip: Keep in mind that banks often mark-up to the exchange rate which can be as much as 6% more than the mid-market rate.

Foreign exchange brokers also have fees attached but they differ from broker to broker so it is worth shipping around.

Professional help: Foreign Exchange service provided by a local wealth management company

Pro Tip: Take your time to go through all additional fees, taxes and costs with your professional advisor to ensure everything is correct.

Professional Help: A lawyer and a real estate agent / A wealth management advisor offering real estate services

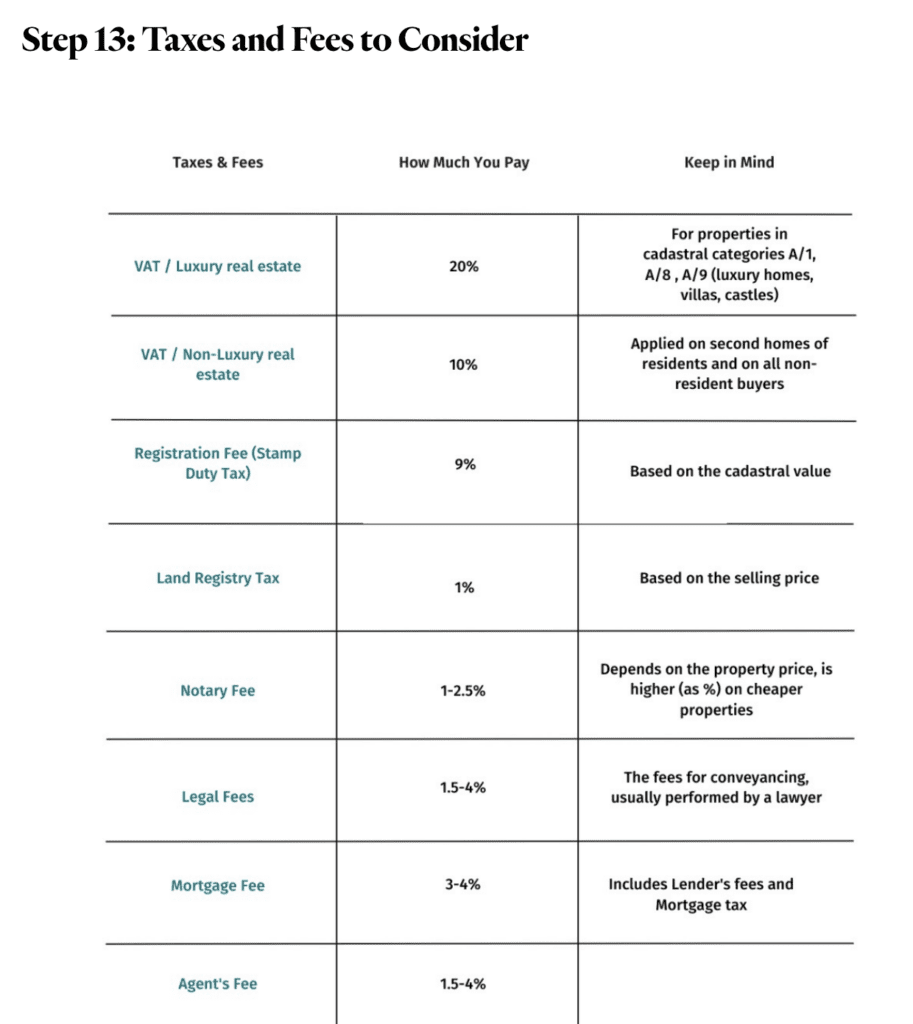

Essential Steps to Buying a Property in Italy – Taxes and Fees to Consider

Essential Steps to Buying a Property in Italy – Taxes and Fees to Consider

Pro Tip: Take your time to go through all additional fees, taxes and costs with your professional advisor to ensure everything is correct.

Professional Help: A real estate lawyer and a real estate agent / A wealth management advisor offering real estate services.

Key Roles in the Home Purchase Process – The Italian Estate Agent

The Italian Estate Agent

Many people who present themselves as estate agents and salespersons in Italy are not qualified nor licensed; be aware of the scammers.

How do you recognize the real agents then?

Estate agents who are qualified and licensed, are registered with their local Chamber of Commerce.

Often their registration number is displayed on their website (indicated as N.REA…) and you can verify it by contacting the Chamber of Commerce directly.

All estate agents and salespersons are required by law to be covered by Professional Indemnity Insurance.

This not only protects estate agents and salespersons, who can be held legally liable for claims arising from wrongful acts (such as negligent acts, errors, and omissions or breaches of professional duty) committed during the performance of professional services, but it also protects your interests.

Not all working agents adhere to the same standards.

Once it comes to choose your estate agent, make sure they are registered with one the following National Associations of Realtors: FIMAA, FIAIP, ANAMA or AICI.

This is a further guarantee of strong work ethics and quality service.

Some estate agents will include many services in their fee, some others won’t.

A good start will be asking your agent what is included and what isn’t.

A real estate agent will help you with the following:

Property Search

Negotiation the selling price

Italian tax code

Italian Bank account

Preliminary contract

Finding a surveyor and/or an architect

Finding a foreign currency broker

Finding a Translator and a Notary Public

Final Deed of Sale

You should request that anyone claiming to be a registered real estate agent show you their patentino di agente di affari in mediazione so that you can verify they’re above board.

It should also be noted that Italian law requires agents to take out a liability insurance policy for the protection of their clients.

Key Roles in the Home Purchase Process – The Property Lawyer

Although it is not a legal requirement to engage a lawyer when buying a property in Italy, an experienced property lawyer can guide you through the complexities of Italian conveyancing and all related paperwork.

Real estate agents cannot provide legale advice and may not be in possession of all the facts about a property.

Entitled to brokerage fees only if a transaction is closed successfully, a real estate agent might not disclose information about a property to a potential buyer.

An independent property lawyer is the only one who can protect your interest.

Key Roles in the Home Purchase Process – The Property Lawyer

Italian property lawyers, consultants and real estate experts help to guide you through the process of purchasing your dream home.

Lawyers may specialize in Italian real estate law and, in particular, cross-border transactions for both residential and commercial clients.

Lawyers are well equipped to deal with transactions that require the understanding of the legal jurisdictions and cultures of multiple countries, which is sometimes necessary to complete a property purchase.

If you are an international buyer, look for a lawyer or law firm that specializes in assisting non-Italian families and businesses with all the aspects and intricacies of the process of purchasing real estate in Italy.

Discuss what areas you need assistance in: real estate planning, due diligence and negotiation of the purchase price, in coordination with the seller and public notary and or tax counseling.

Look for an attorney that serves English-speaking client in investing in property in Italy.

Key Roles in the Home Purchase Process – The Surveyor, Architect, Technical Inspector

When buying a property in Italy do not underestimate the importance of a Geometra (surveyor) or that of an Architetto (architect).

Unless you are looking for a property in need of renovation, a surveyor will suffice.

Appointing a Geometra is key. There are so many things an estate agent can ignore about a property and no matter the number of viewings, no one will be in the position to tell unless a proper survey is made.

Many home owners who are currently listing their properties for sale, may have carried out some work (demolished/built walls, added windows/doors, bathrooms etc) without no building regulation approval.

Should that be the case, said properties would result ‘illegal’ and things could go pretty much down the… hill.

We recommend all our clients to have a full survey, including a structural one, carried out by their Geometra before making an offer on any property in Italy.

A surveyor will tell you if the property is good and sound before you sign any binding paper.

Key Roles in the Home Purchase Process – The Surveyor, Architect, Technical Inspector

Basically, a technical survey is a detailed document that gives you the big picture of the state of your property.

Only a technician (either an engineer or a geometra) can carry out this kind of survey.

The first important thing to know is that in Italy technical surveys are not required by Law, meaning that owners won’t do that spontaneously; rather, clients can make one at their own expense.

In other words, a technical survey is a document clients might want to have for their own peace of mind, but it is not necessary for the sake of the purchase.

Our tip: not getting an expert survey is a false saving especially when it comes to (very) old properties, as you may have problems showing off later on (old homes have some inevitable defects due to their age).

We know that when you’re already spending a lot of money on buying a house, a survey can feel like an unnecessary expense.

But it’s far better to be aware of any problems before you buy a property, so you can make an informed decision about how much you’re willing to pay for it.

In Italy, a technical survey is a report on the condition of the house: this means that the technician will check the general structure and health of the property, but when it comes to inspect in detail the single conditions of specific elements (e.g. plumbing system, electrical system etc.), other designated professionals (e.g plumbers, electricians etc.) will be involved.

The technician checks, for example, the structure of the walls, the damp, the cracks.

It’s not possible to ask the technician to check the condition of pipes and cables, chimneys, and other “hidden”/internal elements.

We know that in many countries there’s the figure of the surveyor, who checks the whole condition of the house.

It’s good to know how the process varies in different countries.

Key Roles in the Home Purchase Process – The Notary Public

The most common mistake done by non-Italian nationals is that the Notaio (Notary Public) is equal to a solicitor or an attorney.

This is not the case.

A notaio (a notary-at-law with legal training, not to be confused with the lessor notary public found in common-law jurisdictions) is a self-employed public official who acts in the general public interest, thus for both the buyer and the seller, to insure the integrity of public deeds, including property transfers, whether they be by purchase, inheritance or court ruling.

A Notaio is an impartial public officer licensed by the Italian State and cannot specifically protect the interest of one of the parties involved in the transaction.

As it is the buyer who is most at risk in the property sales process, custom dictates the notaio is selected by the buyer who pays the notaio fee.

While the notaio is paid for by the buyer, in an apparent contradiction they legally work on behalf of the state and are required to protect the interests of both the buyer and the seller.

In the Italian system the Notaio performs the title search and draws up the deed agreement, conveyancing tasks a lawyer or other professional would perform in countries which use the common law system such as the US and UK.

A Notaio must adhere to strict rules laid down in the code of ethics and the law to ensure that the deeds are in compliance with the law, in accordance with the will of the people, and not affected by encumbrances or rights of third parties that the Notary did not warn about.

The Notary Public must ensure the identification of clients, the beneficial owner of the operation and report any and all suspicious transactions to the Financial Information Unit at the Bank of Italy. (Law on money laundering)

The Italian State relies on the Notary for the collection of taxes and for economically significant operations.

Appointing a Notary is a legal requirement when purchasing a property in Italy.

Notary fees are to be paid by the buying party who is also free to choose the Notary they would like to work with.

No Estate Agent can in any form impose a Notary to a buyer.

A notaio is required by law for drafting and registration of the final sales agreement (deed).

One area of potential misunderstanding is that a notaio does not perform a site-survey: they do not verify the true current state of a property corresponds to what is legally documented beyond taking a statement from the seller, a statement which may or may not be true.

Key Roles in the Home Purchase Process – The Notary Public

In Italy, when you buy a house, you must have a notary. It is the notary who seals the purchase contract.

More specifically, a notary is a public official. Essentially, they are a lawyer who specializes in public deeds.

To obtain their professional license, notaries must have a university degree in law and spend 18 months of training in a notarial office.

Finally, they must undertake a very difficult public exam. If they pass this exam, they’ll be able to access the register of public notaries in Italy.

If not, they’ll have to undertake another 18 months of training, repeating the cycle until the exam is passed.

Here in Italy, it’s the buyer who pays the notary’s fees, plus all taxes related to the purchase.

Therefore, it’s a good idea to get acquainted with the notary who will be doing all legal checks of the property you wish to buy — and who will eventually seal your final deed.

You can choose any notary from the register of public notaries in Italy.

But for obvious reasons, the notary you choose should be situated close to the town where your prospective house is located.

It is also advantageous if the notary (or one of their assistants) speaks English.

Here are five documents that the notary will require:

Atto di provenienza (ownership titles of the house)

Floor plan of the house

Visura catastale (cadastral document of the house)

Attestato di prestazione energetica (energy certificate)

Building permits if the house was built after September 1967

Seller(s) and buyer(s) identification documents: Passports and tax codes (your realtor will provide you with a tax code for free; the process does not take long).

Once the notary has obtained all of the necessary documents and is fully satisfied with them, they will issue an estimate, which will include their fees and the purchase taxes that the buyer must pay on the day of the final signing.

The transfer taxes are paid to the notary, who will then transfer them to the government when they register the deed.

Before this process starts, you must have signed a purchase proposal or a preliminary contract in order to show your real commitment to the purchase.

Essential Steps to Buying a Property in Italy – The Purchase Proposal

Before this process starts, you must have signed a purchase proposal or a preliminary contract in order to show your real commitment to the purchase.

The purchase proposal is a contract where the realtor communicates in writing to the seller your intention to buy the property at a certain price and within a certain amount of time.

The purchase proposal is not binding until both parties have signed it.

If your realtor doesn’t speak English, you should ask a translator of your choice to translate it.

The primary goal of the purchase proposal is to allow time to perform some preliminary due diligence and ensure that the seller won’t attempt to sell the property to anyone else until a certain date.

For example, let’s say you want to have a survey done on the house. A survey isn’t required by the notary in order to seal a deed, so it’s not a mandatory step.

But as a buyer, it might be convenient to know the structural state of the house you’re buying.

So in this case, the successful conclusion of the purchase offer would be determined by the outcome of the survey. If the survey is not satisfactory, the seller would have to return the deposit to you, the buyer.

The purchase proposal is also important if you’re applying for a mortgage as it gives you the time to apply for the mortgage without the risk of losing the house.

Your purchase offer will require a small deposit. This amount has to be returned if the documents of the house are not in perfect order or if the conditions you asked for cannot be met.

Essential Steps to Buying a Property in Italy – Acceptance of the Proposal and Payments

The proposal is usually accompanied by a non-interest bearing deposit in the form of a nontransferable check made out to the seller: the check is returned if the seller does not accept the proposal; on the contrary, in the case of entering into a contract, i.e. when the

buyer learns of the seller’s acceptance, that amount will become the confirmatory down payment.

The definition and the significance of the confirmatory down payment are indicated in Article 1385 of the Civil Code: “If at the time of entering into a contract one party gives to the other, as a down payment, a sum of money, or a quantity of other fungible goods, the down payment in the case of fulfillment must be returned or ascribed to the sale price.

If the party that gave the down payment defaults, the other party may withdraw from the contract, keeping the down payment; if instead the party that received the down payment defaults, the other party may withdraw from the contract and demand double the down payment.

If however the party that does not default prefers to demand the performance or the cancellation of the contract, the compensation for damages is regulated by the general laws.”

It is important to know that with the new laws all payments regarding the purchase of real estate must obligatorily be made by means of cheques or bank transfers, with the exception of transactions for a total value of not more than 12,500.00 euros.

The essential data of

these payments must be kept, because the notary that stipulates the deed must quote them in the deed.

After entering into the contract, the parties are both bound to execute it, and thus also to the subsequent stipulating of the notarial deed with the transferring of the ownership of the real property by the seller and the payment of the price by the buyer.

With the acceptance of the seller and the entering into the contract, the Real Estate Agent, regularly qualified and registered in the List held at the Chamber of Commerce, has the right to receive the commission.

Essential Steps to Buying a Property in Italy – The Preliminary Contract or Agreement

The second step of the purchase process is the preliminary agreement.

The preliminary contract, or Compromesso, is essential in all Italian property purchases.

You ae required to pay between 10% and 30% of the property price as a commitment and confirmation you are buying the property.

It is a legally binding contract which virtually guarantees the purchase.

Once you have your verbal or written offer accepted, you’ve obtained a satisfactory survey, the notary has checked all house documents and provided a final estimate, you have all your funds in order, and you’re ready to buy, this is when you’ll proceed with the preliminary contract.

In Italian, this document is called the compromesso or contratto preliminare.

The preliminary contract states all of the official data about the property, including the agreed upon price, the closing date, the deposit amount, existing mortgages, what’s included (furnishings and fixtures), and any other contractual points that need to be addressed or fulfilled.

The preliminary agreement can be written by your realtor. Usually write the preliminary agreement is written in two languages: English and Italian.

If your realtor doesn’t speak English, you can have the preliminary agreement translated by a translator of your choice.

The preliminary agreement can also be written by your notary.

Generally speaking, the timeframe between the signing of the preliminary agreement and the final signing at the notary office will be between two and three months.

Once signed by all parties, the preliminary agreement becomes a binding document that must be followed by a down payment of 10% of the total price of the property.

Keep in mind that it is possible a seller might require a higher down payment if the buyer asks for a long wait time between the signing of the preliminary contract and the final signing.

When the preliminary agreement is signed by all parties and the agreed upon deposit is paid, the realtor has to register it at the local tax office according to Italian Law.

In the event that the buyer backs out of the deal, he’ll lose his deposit to the seller.

On the other hand, if the seller reneges on the contract, he’ll have to pay the buyer double the amount received.

Pro Tip: While property deposits can be up to 30% in Italy, they are usually around 20%.

Professional Help: A real estate agent / A wealth management advisor offering real estate services.

The Registering of the Purchase Proposal and of the Preliminary Contract

A preliminary agreement to sell contract, whether done by means of a notarial deed or a private deed, is subject to registration within a fixed time period at the Revenue Office, i.e. Ufficio delle Entrate (only preliminary contracts by enterprises owning developable land

without a down payment are not subject to registration within a fixed time period).

In addition, Art. 1, paragraph 46 of Law 27 December 2006 no. 296 extends the obligation of requesting registration also to the real estate agent and makes the agent jointly liable for payment of the registration tax.

The registration of the preliminary and of the purchase proposal is done at the Revenue Office and may be done by anyone, within 20 days from the notification of the seller’s acceptance to the proposer for the purchase proposal, and within 20 days from its stipulation

for the preliminary.

The registration tax is 168.00 euros. If there is a down payment, it is also taxed at the rate of 0.50%.

If there are advance payments, it is necessary to distinguish:

If the final contract is subject to VAT, the advance payments must be invoiced by the promisor seller at the same rate as that of the transfer (e.g. 4% on a first home);

if the final contract is subject to payment of the proportional registration tax, 3% on the amount of the advance must be paid.

For both down payments and advance payments, the taxes paid with the preliminary contract will be deducted from the taxes to be paid for the registration of the final sale contract, with the exception of sales subject to VAT.

Essential Steps to Buying a Property in Italy – Transcription of the Preliminary Contract

Always evaluate the great opportuneness of transcribing the preliminary contract at the Agenzia del Territorio Servizio di Pubblicità Immobiliare (Land Agency – Real Estate Advertising Service), stipulating said contract in a notarial deed, especially if the seller is a contractor, or a company that could go bankrupt, if a fairly long period of time will pass between the preliminary contract and the deed of sale or if the down payment is very large.

Unlike the registration, which is valid essentially for tax purposes, the transcription is aimed at protecting the future buyer:

It avoids the danger of prejudicial formalities (sale to others, mortgages, distraints…) that could be transcribed or registered before the final contract;

It attributes to the future buyer a lien in the case of the bankruptcy of the seller: following the compulsory sale of the bankrupt’s properties and the distribution of the proceeds among the creditors, the future buyer is given preference over the bankrupt’s other creditors, including mortgage creditors;

It blocks the challenge of antecedent transactions and the power of the receiver to opt for dissolution, when the preliminary contract has been entered “at a fair price” and regards a building for use as a dwelling, which is to be the main residence of the buyer or the buyer’s family or kin up to the third degree.

Essential Steps to Buying a Property in Italy – Final Deed of Sale

At this point, when the preliminary agreement has been signed and the deposit paid, the notary will start to write the final deed or rogito.

The signing of the final deed is the last step in the purchase process.

It must be signed at the notary office in front of the notary.

If you do not plan on being present during the closing, then you should give someone power of attorney to sign on your behalf.

This person can be your realtor, an assistant to the notary, a friend, or anyone else in Italy you trust. If you plan to be present at the closing but you’re not fluent in Italian, you’ll still need to give power of attorney to someone who speaks Italian so that they can act on your behalf.

Otherwise, if the notary allows it, you may appoint a translator to translate the title deed into English, which will allow you to sign the document. In this case, the translator must be present during the signing to act as an interpreter.

Keep in mind that not all notaries will consent to this; therefore, always be sure to ask your notary what their particular policies are.

Without a doubt, it is to your advantage to find a notary who speaks English.

Not only will this allow you to ask any questions you have directly to the notary, but you also won’t need to hire an interpreter or translator.

Moreover, your notary will be able to explain every step of the final signing to you as you close the purchase of your new property.

You will certainly want to establish an Italian bank account eventually so that you can more easily pay utilities and other expenses associated with maintaining your property.

Finally, you can sign the final title deed or Rogito.

This represents the final contract before the property is finally yours.

You pay purchase taxes and notary fees at this point.

The time between preliminary and final contracts is usually between one and three months, as this is when an independent Notary is appointed.

Pro Tip: The Notary works for both the buyer and the seller they prepare the deeds and must be present as the document is signed to make it legally binding.

Professional Help: A lawyer and a real estate agent / A wealth management advisor offering real estate services

Second Home Market Review For Italy >>

The Essentials for European Travel >>